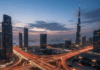

The United Arab Emirates property market has matured into a two-speed story: prime Dubai still attracts global capital, while investors are increasingly studying earlier-cycle districts where tourism and infrastructure can re-rate pricing over a few years. One useful signal of that long-horizon mindset is the planned expansion of Dubai International Financial Centre, a large-scale development that reinforces the broader narrative of continued investment in jobs, services, mobility and “city making” that tends to support real estate liquidity over time.

For buyers comparing off-plan options in Ras Al Khaimah — especially in waterfront clusters like Al Marjan Island and Fairmont Residences al Marjan Island — the real advantage usually comes from having a clean, structured view of the market before emotions kick in. A specialist portal such as Al Marjan Properties can be helpful here: projects are listed in a consistent format, developers have dedicated pages, and it’s straightforward to move from browsing to a consultation without getting lost in a maze of listings.

Where that structure matters most is in filtering “headline prices” into comparable decisions. Payment plans, service charges, handover timelines, and micro-location (views, beach access, hotel adjacency, walkability) can change the true investment profile even when two units look similar on paper. The services outlined by the company lean into this reality: market analysis and investment advice, flexible consultation options (including online), and support that’s designed to help buyers narrow choices based on inputs that actually move returns and resale value.

On the practical side, many UAE transactions succeed or fail on execution details — especially for overseas buyers. The same service list emphasizes assistance with document handling (buying, selling, renting), plus virtual tours so clients can review units remotely while they shortlist and negotiate. They also state common payment methods up front (bank transfer, cash, cryptocurrency), which helps planning — but it’s still worth pairing speed with standard due diligence, clear receipts, and compliance checks so the transaction remains clean and bankable later.

Zooming out, Ras Al Khaimah is actively pitching for more international investment and is targeting a major step-up in tourism by 2030, with high-profile development on Al Marjan Island including Wynn Resorts’ planned integrated resort in the coming years — exactly the kind of catalyst that can reshape rental demand and buyer sentiment if delivered on schedule. Complement that with the broader UAE backdrop — where consultancies continue to track robust activity across residential and leasing segments — and you get a market where disciplined selection tends to outperform hype-driven buying.

The investor takeaway is simple: treat UAE real estate as a process, not a pitch. Build a shortlist you can defend with fundamentals (developer track record, escrow structure, service-charge transparency, payment schedule, exit logic), and use structured market views and consultation-led selection to avoid expensive “nice render” mistakes. In a market moving fast, the winners are usually the buyers who stay boring, consistent, and document-driven.

Добавить комментарий